THE FIRST HALF 2015 IN REVIEW; AND TODAY’S BIG QUESTION FOR U.S. INVESTORS

THE FIRST HALF IN REVIEW;

AND TODAY’S BIG QUESTION FOR U.S. INVESTORS

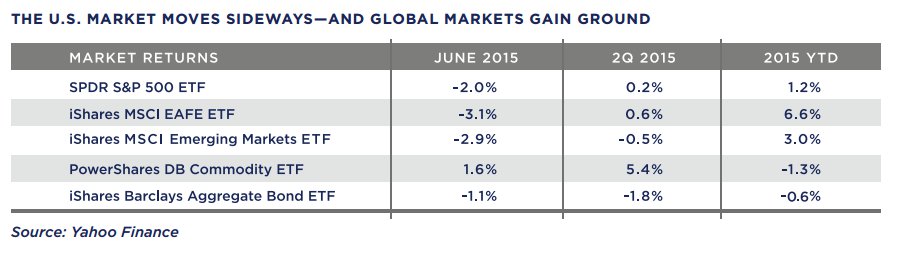

In this review of the first half of 2015, we also address one of the biggest questions for investors: Do U.S. stocks at today’s levels still offer compelling value?

HERE’S WHAT HAPPENED IN THE FIRST HALF OF 2015 IN THE U.S., EUROPE AND CHINA

UNITED STATES

The outperformance in foreign markets is not a reflection of lack of strength in the U.S. economy; after an early slump due to severe weather this past winter, the U.S. still leads the developed world in its growth. There are continued positive signs in most traditional indicators of economic activity such as housing, auto sales, retail sales, and employment among others.

Outside of the energy sector, which has been hit hard by the sharp drop in oil prices, 2015 corporate profits are expected to show solid growth with profit projections upgraded from earlier this year. The one cloud on the horizon is the impact of the stronger dollar, as the value of profits in overseas markets drops and some U.S. manufacturers find themselves struggling to keep prices competitive with foreign rivals.

EUROPE

Going into the second quarter, strong leadership by the European Central Bank improved the outlook for Europe’s economies. European multinationals have seen their competitiveness increase due to the fall in value of the euro. Consumers have benefited from the drop in oil prices since the middle of 2014, with the prospect of stronger consumer spending as a result.

Earlier this spring, there was a general sense that accommodation would be reached with the far-left anti-austerity government elected in Greece. The latter part of June saw a confrontation between Greece’s leaders and its European creditors, culminating with a referendum on July 5th in which voters rejected austerity measures associated with a bailout proposal. While there was much concern last week regarding Greece potentially exiting the Eurozone, an eleventh hour bailout plan was agreed upon this weekend which appears to have averted crisis—for now.

European stocks and bonds will likely see increased volatility over the period ahead, although given that Greece’s economy is about the size of Alabama’s and only makes up 1% of Europe’s economy, this should not have lasting effects as long as instability does not spread to larger economies such as Italy and Spain. This New York Times article provides background on how Greece got to this point and the implications for Europe as a whole.

CHINA

While Greece has received lots of attention, the true wild card when it comes to global growth is China. After three decades of 10%-plus annual growth (something never before seen for an economy its size) and having helped fuel the recovery after the global financial crisis, the rate of growth of China’s economy is slowing to mid-single digits. China’s uncertain growth prospects are driven by substantial overcapacity in its factories, the prospect of a sharp drop in real estate prices and what appears to be a full-fledged bubble in stock valuations. Of note, stock prices doubled in the seven months to mid-June, much of that driven by individuals borrowing on margin to participate in a speculative frenzy, before dropping by more than 25% in the next three weeks. China has taken actions to stem the tide, but concerns remain over spillover effects into the regional and global economy.

With this background, let us turn to one of the big issues for investors today: after having tripled since the market’s bottom in March of 2009, do U.S. stocks still provide enough upside potential to justify their downside risk?

THE VALUATION QUANDARY

In March, CNN ran a commentary celebrating the sixth anniversary of the bull market in U.S. stocks markets. Any time that you see a largely uninterrupted run up like that, inevitable questions arise about whether stocks still offer value.

In March, CNN ran a commentary celebrating the sixth anniversary of the bull market in U.S. stocks markets. Any time that you see a largely uninterrupted run up like that, inevitable questions arise about whether stocks still offer value.

In formulating recommendations for client portfolios, we look at a broad range of sources. We pay special attention to experts who have been through multiple market cycles and have a superior track record. One such person is activist investor and 50-year industry veteran Carl Icahn, known for his public confrontations with company management teams and for his 2013 profit of $850 million when he sold part of his stake in Netflix. This June Wall Street Journal article, Carl Icahn Says the Market is Extremely Overheated, described his concerns about stock valuations.

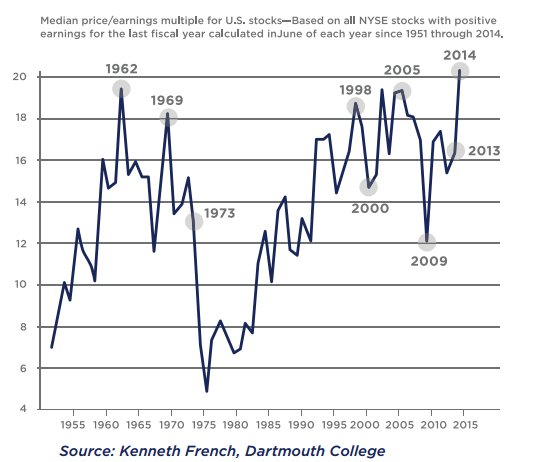

Icahn is not alone in his concerns. Earlier this year, a chart (see prior page) circulated showing the average stock on the New York Stock exchange selling for the highest multiple ever, above levels before the tech bubble and the global financial crisis.

Traditional market indices are weighted by a stock’s market value, so price movements by Apple at a market value of $750 billion have three and a half times the impact of Coca-Cola at $200 billion and 35 times the value of Marriott Hotels, whose market value is roughly $20 billion. In the chart above, every stock is given the same weight, so that movements by Marriott count the same as Apple. What this chart reflects is that among the factors driving the rise in stock prices, smaller and more speculative stocks have generally outperformed, as access to cheap money has allowed some stocks to do well that otherwise might have struggled.

A WARNING FROM A NOBEL LAUREATE

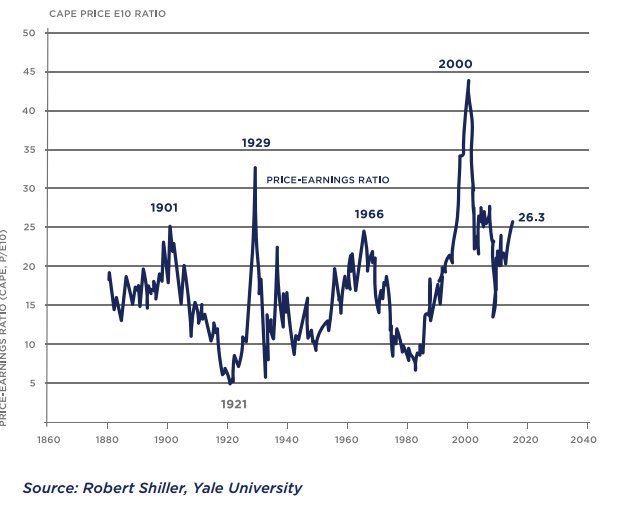

In our client letter at the end of last year, we pointed to a comprehensive study by Vanguard on forecasting stock returns that examined 15 popular measures used to predict returns. While no measure had meaningful predictive power in the nearterm, the best predictor of future returns over the mid-term used earnings for the previous 10 years adjusted for inflation, an approach popularized by Yale’s Robert Shiller, recipient of the 2013 Nobel Prize for economics and someone who predicted both the tech crash and the implosion of real estate prices.

Using this metric, the outcome is concerning: At the end of June, the U.S. stock market was priced at about 27 times average earnings for the past 10 years, more than 50% above the long term average of 16 times 10-year earnings. While this valuation does not approach the 44 times seen at the height of the tech bubble, it does suggest that in the next 10 years, returns on U.S. stocks will likely be lower than their historical average.

Shiller urges investors to be cautious, but also emphasizes that this measure is not designed to time when to enter and exit the market in the short-term. He points out that even when high, the market can continue to rise, and the market can also fall even when this measure is low.

THE OTHER VIEW ON VALUATIONS

Central to the “fairly priced” argument are today’s historically low interest rates. When rates are ultra-low as they are today, the present value of a dollar of earnings five and ten years from now is considerably higher than if interest rates were 6% or 8%. Some industry participants use that to justify higher valuations than the norm. This was the view expressed by Wharton’s Jeremy Siegel, author of Stocks for the Long Run and a leading authority on stock-market history.

Siegel’s sentiments were echoed by highly respected veteran Jeremy Grantham, historically a voice of caution. In a recent talk, Grantham said that while stocks are “creeping towards a bubble,” they aren’t there yet. While urging prudence and caution, particularly given corporate profit margins are at all-time highs, he suggested that the low interest environment since the beginning of 2000 may have altered the traditional math on what constitutes fair valuations.

WHAT THIS MEANS FOR INVESTORS

Even experts who view the market as fairly priced urge caution. And being prudent and cautious is the same view that we take in building portfolios for clients. Being cautious means a few things to us: keep portfolios in balance, stay diversified while looking for the best possible value, don’t be afraid of holding cash to control risk, and make sure to stay focused on financial goals and avoid getting distracted by market noise.

STAYING IN BALANCE

A lesson from the world’s wealthiest families and most sophisticated investors is the importance of not just starting with a diversified portfolio but maintaining that diversification as markets rise and fall. As a result of the strong performance by stocks over the last number of years, unless funds have been reallocated along the way, portfolios that had the right balance three years ago are out of balance today with an overweighting to equities. That overweight can lead to greater downside risk than was built into the original portfolio. As we periodically review portfolios we look to trim outsized positions and reallocate to under-represented assets or more attractive opportunities.

DIVERSIFICATION

One of the best ways to control portfolio risk is through disciplined diversification. Diversification doesn’t mean holding a mix of just stocks and bonds; it also entails ensuring that there is broad exposure across multiple asset classes. The foundation of our portfolios is diversified across various economic regimes, with a global array of stocks selected to drive returns in periods of economic expansion, bonds included to provide insulation when economies contract, real assets to participate in inflationary times, Treasury Inflation Protected securities and precious metals are used to protect portfolios when growth is low and inflation exists, and two basic alternative strategies that have the potential to provide positive returns regardless of the general direction of the markets. On top of the foundation we layer strategies with objectives specific to each client. These customized strategies are carefully constructed so that they too are well diversified and provide further diversification to the portfolio as a whole.

CONTROLLING RISK

We design portfolios with the aim of providing clients with the best possible returns on a risk-adjusted basis over a full-market cycle. To do that, we look at the broadest possible range of alternatives, both within the U.S. and around the world. We use strategies that target low volatility equities within our foundation portfolio and our growth focused strategies, we use bond strategies that have lower than market interest rate risk, and we will even raise cash when appropriate in an attempt to avoid prolonged downturns. Notions of risk and risk mitigation permeate everything we do.

STAYING FOCUSED

Our strategy for staying on course and minimizing poor decisions revolves around developing a sound long-term investment plan and focusing on the long-term implications of short-term decisions.

Ultimately, every client’s needs are unique, and we work hard to customize the portfolio that is right for your personal risk tolerance and situation. We always welcome the opportunity to sit down to update your circumstances and to ensure that your portfolio is designed to provide the returns required to achieve your long-term goals with no more risk than is necessary. We hope that you have found this review helpful. Please don’t hesitate to give us a call or send an email if you have any questions. Thank you for your trust in Signal Ridge Capital Partners.